SUMMARY:

India’s Transit Rolling Stock market is expected to generate a total turnover of INR XX-XX crore (about USD XX-XX billion) over the next five financial years. This growth is being driven by bilateral and multilateral budget support and key infrastructure projects aimed at boosting the country’s development.

Markets Covered:

● RRTS

● Metro

● Metrolite

● Water Metro

● Airport Express

● Metroneo

● Monorail

Major projects like the RRTS trainsets, Airport Express, Water Metro, and Metrolite are pushing the industry forward.

These projects are attracting more suppliers to the market, many of whom are now better equipped to deliver high-quality, advanced products needed for this kind of development.

Government policies like the Metro Rail Policy and Viksit Bharat 2047, along with initiatives such as RRTS, Metrolite, and Metroneo are shaping the future of the transit industry. These efforts are creating strong opportunities for companies in the sector, driving both growth and innovation. For suppliers, this expanding market is a valuable chance to invest in and grow their manufacturing capabilities.

| Contents | |

|---|---|

| ● List of Abbreviations used in the Report | ● Executive Summary |

| ● Key takeaways for the Rolling stock market | ● Research Methodology |

| Transit Market | |

| ● Transit Industry Overview | ● Market Dynamics |

| ● Key Trends | ● PEST Analysis |

| Rolling Stock types | |

| ● Monorail | ● Metro |

| ● Metrolite | ● Metroneo |

| ● Water Metro | ● RRTS |

| Project Status | |

| ● Monorail | ● Metro |

| ● Metrolite | ● Metroneo |

| ● Water Metro | ● RRTS |

| Project Details | |

| ● Metro | ● Metrolite |

| ● Other Transit Projects | ● RRTS |

| Key Insights | |

| ● Policies & Programmes | ● Mergers, Acquisitions and Partnerships |

| ● Porter’s Five Forces Analysis | ● Technological Developments |

| Market Analysis | |

| ● Transit Market in India | ● Transit Market Assessment |

| ● Future Market – Details | ● Pricing- Expected |

| Total Addressable Assessment | |

| Industry Insights | |

| ● Disruptive innovation in the Industry | ● Growth strategy of leading players |

| ● New developments | ● Significant Contracts |

| ● Future Contracts Expected | |

| Supplier Overview | |

| ● Present Rolling Stock Major Suppliers- Profiles | |

| ○ Alstom Transport India | |

| ○ Banaras Locomotive Works (BLW) | |

| ○ Bharat Earth Movers Limited (BEML) | |

| ○ Bharat Heavy Electricals Limited (BHEL) | |

| ○ Braithwaite & Co. Limited | |

| ○ Bridge & Roof Co. (India) Limited | |

| ○ CG Power and Industrial Solutions Limited (CGL) | |

| ○ Chittaranjan Locomotive Works (CLW) | |

| ○ CRRC India Private Limited | |

| ○ Hindusthan Engineering & Industries Limited | |

| ○ Integral Coach Factory (ICF) | |

| ○ Jindal Rail Infrastructure Limited | |

| ○ Jupiter Wagons Limited | |

| ○ Kinet Railway Solutions Limited | |

| ○ Modern Coach Factory (MCF) | |

| ○ Modern Industries Limited | |

| ○ Medha Servo Drives | |

| ○ Om Besco Rail Products Limited | |

| ○ Oriental Foundry Private Limited | |

| ○ Rail Coach Factory (RCF) | |

| ○ Rail Vikas Nigam Limited (RVNL) | |

| ○ SAIL-Rites Bengal Wagon Industry Private Limited | |

| ○ Saini Heavy Electrical and Engineering Works Pvt. Ltd | |

| ○ Siemens India | |

| ○ Texmaco Rail & Engineering Limited | |

| ○ Titagarh Rail Systems Limited | |

| ○ Wabtec India | |

| Market Analysis | |

| ● Industry SWOT Analysis | ● Conclusion |

For this report, We have relied on varying inputs across the industry and the main challenge has been to find the most comprehensive insight to the rolling stock market in India.

The detailed methodology followed by us is:

| Insights based on Primary Research | ● We had in-depth discussions with a range of industry professionals from the rail and metro sectors in order to obtain a thorough grasp of the state of the market at the moment and the most recent changes to policy in India’s rolling stock market. Additionally, we identified the main trends that will likely influence the market’s future potential. |

|---|---|

| Secondary Desk based Research | ● The primary research was followed by desk-based research, utilizing both publicly available and verified secondary sources. The insights and intelligence were also derived from our daily news feeds and company database. |

| Additional Sources | ● Additional information was obtained from public documents, interviews, and project announcements. A significant number of press releases and tenders were also thoroughly analyzed. |

| Research Assumptions | ● This research and analysis aim to provide an understanding of sector-based opportunities in India, particularly focusing on various railway and metro sector policies and developments. ● The study primarily connects available insights from the public domain with perspectives from industry specialists and experts to garner deep insights. ● Our focus has been on the complete rolling stock itself, without delving into the component mix. ● The exchange rate calculated for 1 USD is 83.00 INR. ● The expected price increase for future contracts is due to inflation, rising labour prices, price variance clause and raw material costs. ● This report does not address aftermarket suppliers or maintenance contracts. |

Indian Metro Rolling Stock Market of India (2025-2030)

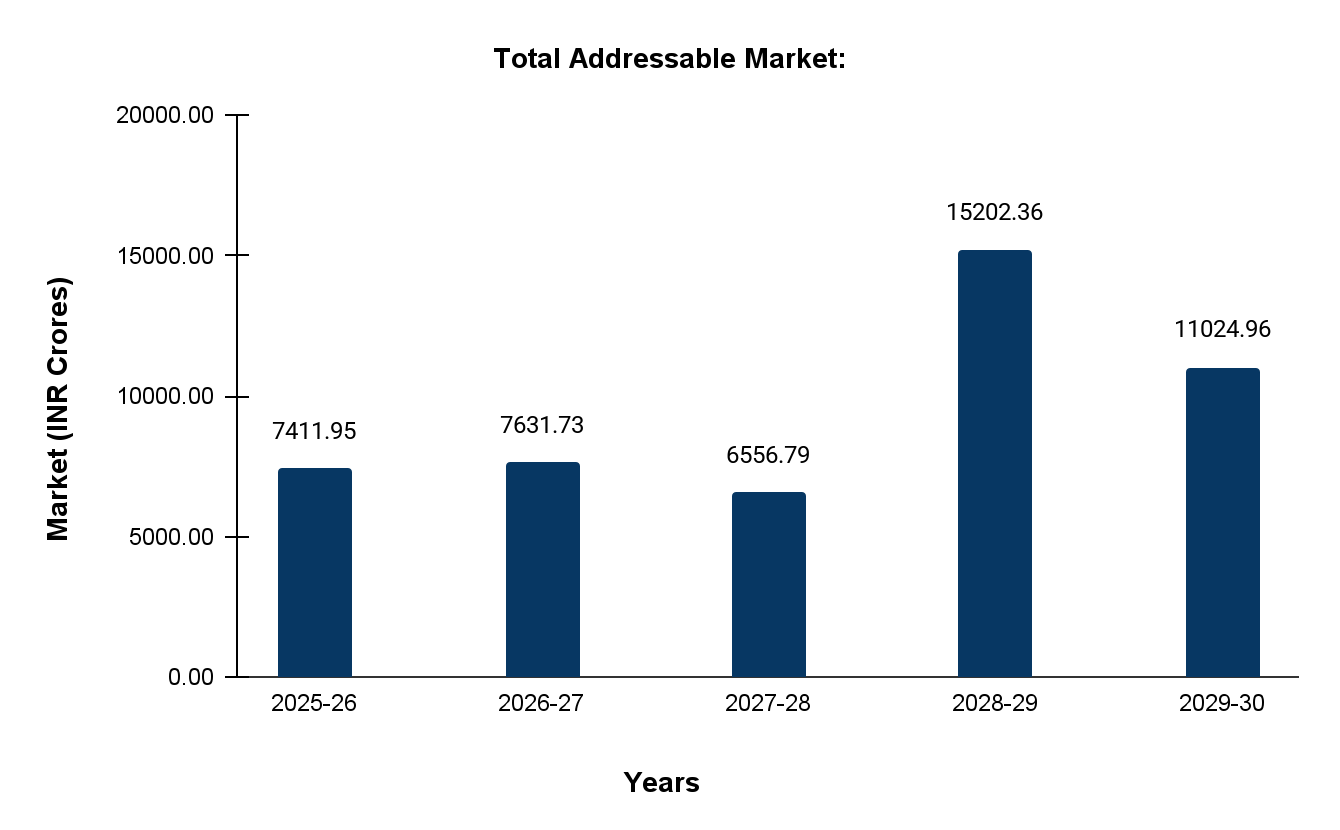

The addressable market is calculated for YoY growth. As a planned approach, We have Calculated the quantity and estimates for all major contracts for the potential projects expected to be awarded across all requirements in the transit projects.

We have estimated the market till 2029-30 as a more practical approach as per the details on the bottom table. The Total Addressable Market has been calculated below for the next 5 years and we expect the progress of the projects in India to increase pace.

Sample:

Total Addressable Market:

Rolling Stock market expected in the future:

FAQs:

The report covers the market dynamics, rolling stock types, key trends, supplier profiles, upcoming contracts, and future outlook for India’s metro rolling stock sector.

The report addresses the following systems: RRTS, Water Metro, Monorail, Metro, Metrolite, and Metroneo.

With more than 1,000 km of metro projects planned and another 600+ km under construction, the report predicts a significant increase in demand as a result of growing networks.

Among the trends are digital ticketing, standardisation, clean energy use, automation (such as driverless trains) and export prospects.

Yes, India is becoming a hub for global supply with exports to regions like Queensland and Sydney. Also multiple component exports are going on to cities across the world.

About us

We specialise in Market Research & Strategic Consulting for companies looking to diversify or expand their production for the Indian market. From assisting and understanding the market, developing a market strategy to establish their operations , together with strong local project partners, we are able to provide a complete insight into the Indian market